Zentrixium is a website that addresses investment education needs by connecting investment tutors with investment learners. The website is dedicated to settling people’s needs for investment education, as much attention is not paid to that area nowadays.

The Zentrixium website accommodates people from all walks of life to enjoy investment education. When connected, people will start to learn the basics of investment - the meaning, terminologies, types, and risks - and move on to the advanced part of the learning process.

Anyone connected with investment education firms can choose from the wide range of teaching programs available or request a personalized syllabus. Registering on Zentrixium is free. The website only requests for a name, email address, and phone number. After this, a representative from an investment education company will contact their match via phone.

Develop the skills and abilities for the finance scene. Learn how to budget, spend, save, and invest. Understand finances like never before by learning from investment tutors. Acquire financial literacy by registering on Zentrixium.

Zentrixium handles the search for investment education firms and the connection process, relieving prospective learners of the stress involved.

Learners can simply focus on the journey ahead, as the investment education firms they are connected with will provide suitable training. It all begins at Zentrixium. Register for free.

Connecting with investment education firms and learning from them opens people’s minds to applying the knowledge gathered.

Acquired investment knowledge can be applied to one’s life and finances. To get and apply investment knowledge, register for free on Zentrixium.

Registering and connecting with investment education companies on Zentrixium is free. Why not sign up?

Zentrixium promotes virtual learning, saving people from the stress of commuting to a learning center. The website helps people learn about investment from anywhere.

Anyone can register on Zentrixium to get investment education. Prior investment education is not required to register and connect with investment tutors. Register on Zentrixium and connect to start learning.

Investment education transfers investment knowledge, skills, and instructions from a teacher to a learner in a structured environment. The structured environment could be a physical or digital classroom setting where an investment syllabus is taught.

Tutors in this educational environment impact their students with soft and hard investment skills. The students learn investment strategies, risks, risk mitigation techniques, and portfolio management. Want to get an investment education? Click the sign-up button and fill out the form.

An Investment education company is a physical or non-physical institution that accommodates people to impart them with investment knowledge and skills.

The firm gives people the skills to understand and operate in the investment world. Some functions of an investment education company are listed below:

An investment education company begins its teaching process with basic investment terms and meanings. Along the line, people will start communicating using these terms. Some terminologies are assets, asset allocation, portfolio, real estate, cash equivalent, broker, security, stock, bond, and diversification. Register on Zentrixium to learn more.

To direct an investment teaching program, investment education companies prepare documents that outline all the topics. The documents also carry the due dates of each topic, assignments, tests, and course policies. The teaching syllabus highlights an investment teaching batch’s start and end dates.

Analyzing Complicated Content

Investment education companies ensure to simplify complex investment information for their students.

Conducting Appraisals

Students are periodically assessed to confirm their understanding of what they have learned and the potency of the training on them.

Researching

As teachers of investments, people running investment education companies conduct timely and periodic research.

In their research, they dig out historical information and current topics, weaving them to show changes in the investment world over the years. The firms also research updates to investment strategies, risk mitigation techniques, and tools and bring people up to speed with them.

Investment education companies do not only teach investment topics. The companies continually solve students’ issues, help with comprehension, answer questions, and give encouragement. Ready to start learning what investment education firms deliver? Sign up on Zentrixium to start. Registration is free, and connection to a tutor is fast.

Investing is putting money into or buying a financial asset for possible gains. Returns may be made off financial assets when their value appreciates. If it depreciates, there will be a loss. Assets might appreciate or depreciate due to several factors, including market conditions, demand and supply, and government policies.

While assets might yield gains, they can also bring losses based on the mentioned factors (and more). There is often the misconception that assets’ value will always appreciate. Another misconception is that an asset or portfolio will perform well if managed by an expert or experienced investor. The expertise and experience of an investor can help them interpret trends or the market well but cannot prevent unplanned market conditions.

Some believe that an asset’s past performance will automatically guarantee the success of a new one. Assets are different, and the period of investment is not the same. Therefore, it may be unwise to judge the performance of one asset by that of another. Register on Zentrixium to learn more about the misconceptions and the reality of investments.

The three major ones are stocks, bonds, and cash. A stock is a type of security that depicts the fractional ownership of a company. Stock ownership privileges are capital appreciation, income, and voting rights. Types of stocks include growth, common, micro-cap, preferred, defensive, cyclical, and income.

A bond is often issued by a corporate entity and given by a bondholder. Bonds are used to cater to capital-intensive projects. On the other hand, cash is a short–term investment in liquid assets. We discuss some investment strategies below:

Momentum investing is the strategy for buying assets with repeated price increases and short-selling assets that have performed less over time. This strategy focuses more on investing short term. Technical analysis tools for this strategy include stochastic oscillator, trend lines, the average directional index, and moving averages.

Passive index investing puts money into exchange-traded funds (ETFs) or index-tracking mutual. This strategy lowers management fees and allows asset diversification across diverse sectors, long-term outlook, and buy-and-hold strategy execution. On the flip side, it is prone to volatility, relies on the performance of the underlying index, and cannot outperform the market.

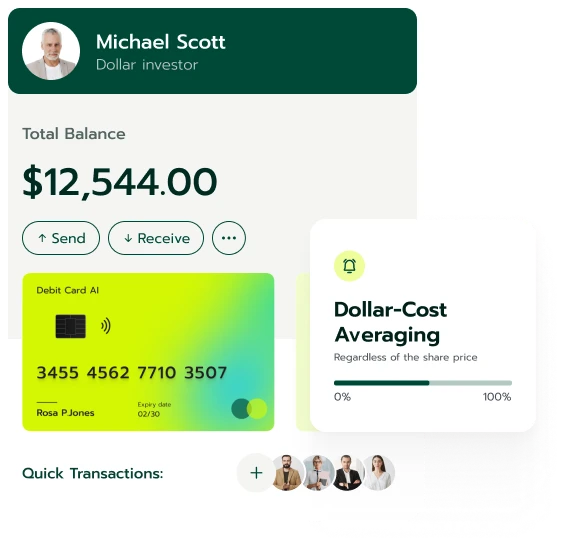

Dollar-cost averaging is a strategy for investing a set amount of money at intervals. This strategy requires minimal maintenance, eliminates emotional investing, and may increase future gains when prices decline. Yet, it requires a constant cash flow, and its average cost basis decreases when prices decline, causing an increased tax liability.

Growth investing focuses more on asset earnings and reinvesting. While evaluating a company’s growth potential, investors analyze the strength of its stock performance, historical earnings, forward margins, and return on equity. Discover more about investment strategies by connecting with investment education firms on Zentrixium.

Investment risks remove the certainty of an asset’s successful performance. Risks place a lot of uncertainties on an investment’s performance. The two major risk types are systematic and unsystematic risks. Systematic risks are caused by uncontrollable circumstances like government policies, natural disasters, and pandemics.

Unsystematic risks are specific to an industry or company. These risks do not affect all forms of investments on a general or global scale, like systematic risks. Want to get more information about the types of systematic and unsystematic risks? Register on Zentrixium.

The five technical analysis tools for momentum investing are moving averages, the average directional index, stochastic oscillator, and trend lines. A moving average identifies leading investment trends and eliminates distractions.

An average directional index identifies an existing trend and its strength. A stochastic oscillator compares an asset’s price over a period with its most recent closing price.

Trend lines monitor price movements. An upward slope on a resulting line signifies a bullish trend, while a downward slope shows a bearish market. Learn how to conduct technical analysis for momentum investing.

Asset allocation is a strategy for dividing investment portfolios across different asset classes to minimize risks. Asset allocation strategies include dynamic, tactical, and strategic asset allocation. Dynamic asset allocation is a continuous portfolio adjustment based on market conditions. Tactical asset allocation adjusts an asset mix to take advantage of a market, while strategic asset allocation sets target allocation for assets and periodically rebalances the portfolio.

An institutional investor is an organization that buys, sells, and monitors investments for others at a fee.

An investment broker sells assets on behalf of others and serves as an intermediary between an investor and an exchange.

A financial advisor offers professional advice to individuals or corporate entities on investment matters or financial issues in general.

A financial analyst makes data-backed decisions in the investment sector. The professional gathers data, analyzes them, forecasts, and makes investment recommendations.

An investment banker offers advisory needs to corporations and governments. This personnel also underwrites deals and handles mergers and acquisitions.

A risk analyst studies past and current investment and risk patterns to make meaningful decisions.

Investment education equips people with financial skills and shapes their perspectives. A suitable financial education helps people make informed decisions. Ready to enjoy financial literacy? It all begins at Zentrixium. Sign up by submitting a name, email, and phone number. It is free and fast.

| 🤖 Cost to Join | Sign up at no cost |

| 💰 Service Fees | Absolutely no charges |

| 📋 Enrollment Process | Quick and easy sign-up process |

| 📊 Learning Areas | Training on Crypto, FX Trading, Equity Funds, and More |

| 🌎 Regions Served | Serviceable in almost all nations but not in the USA |